Might you obtain a mortgage loan as opposed to an assessment? The solution was yes. Having a great PIW (Property Inspection Waiver) Mortgage, you can safe a mortgage without the need to purchase hundreds of dollars with the a house inspection.

Within the home buying techniques, an element of the underwriting techniques concerns buying a house appraisal. Although not, a program called the “Assets Assessment Waiver” has been produced lately.

This method makes you get mortgage approval as opposed to demanding an enthusiastic assessment. Its open to both earliest-big date home buyers and folks trying to re-finance their home loan less than certain factors.

In this post, we are going to mention the entire process of getting an assessment waiver and the reasons why you you are going to consider going for this option.

Table out-of Material

- Exactly how PIW’s Work with Fl

- FHA, Virtual assistant, and you can Antique Property Assessment Waiver Qualifications

- Positives and negatives regarding Possessions Check Waivers

- How-to Qualify for a home Assessment Waiver

- Credit rating getting Assessment Waiver

- Really does this new Virtual assistant Promote Assessment Waivers?

- Are Assessment Waivers an awful idea?

How PIW’s Are employed in Florida

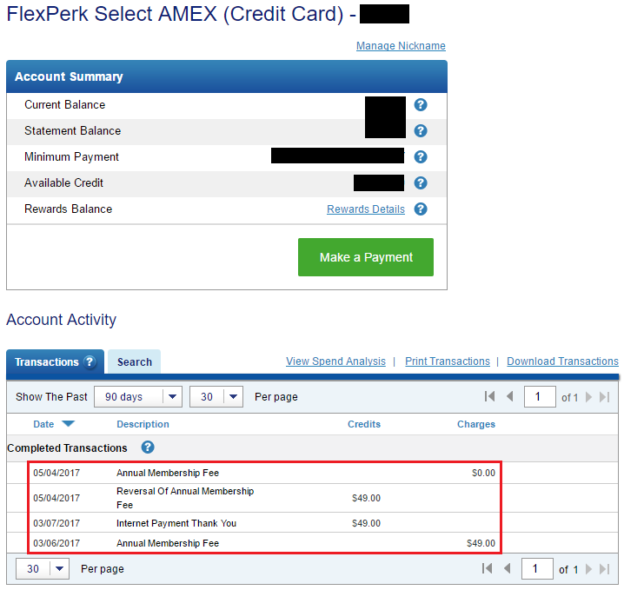

Brand new waiver program try put in Fl back in 2017, initially by the bodies-sponsored enterprise (GSE) Federal national mortgage association and later extended to add Freddie Mac computer.

In the sun Condition, the application form enforce entirely so you can antique mortgages having property orders, providing particular consumers and you will attributes the opportunity to obtain yet another mortgage in the place of undergoing a full assessment declaration.

Additionally, homeowners seeking re-finance and you can holding Va, USDA, otherwise FHA-supported money could be qualified to receive streamlined re-finance programs, that will sidestep the necessity for a vintage http://elitecashadvance.com/installment-loans-oh/fresno assessment.

Florida’s Property Assessment Waiver offerings are facilitated using an automated underwriting system (AUS) that utilizes computers data with just minimal peoples input.

This AUS evaluates several products eg income, a position background, borrowing, and you may possessions, very important to lenders so you can originate mortgage loans, while also making use of established possessions research instead of asking an appraiser.

This particular feature demonstrates including beneficial in places including Fl, where the market has experienced high consult one outstrips also provide, leading to an excellent backlog of assessment sales.

So you can qualify for an excellent PIW, borrowers will should make a substantial advance payment regarding within least 20% having property orders otherwise keeps built-up at the very least 10% collateral within belongings to own refinances.

For those selecting a funds-out refinance to view funds exceeding its newest financial balance, a higher still amount of guarantee regarding the property is requisite to get eligible for an excellent PIW from inside the Florida.

FHA, Va, and Conventional Property Review Waiver Qualifications

Federal Homes Administration (FHA), Pros Facts (VA), and you will United states Department of Agriculture (USDA) funds generally dont bring appraisal waivers. Although not, you will find exclusions definitely applications:

- USDA – Refinance smooth and you will sleek-help – No appraisal becomes necessary, apart from Head 502 financing.

For financing supported by Fannie mae and you can Freddie Mac computer, assessment waivers (AW) or automated collateral product reviews (ACE) may be readily available for the next type of features and you can deals:

Limited dollars-aside re-finance deals with particular loan-to-worth (LTV) and shared loan-to-worthy of (CLTV) rates getting number one homes, 2nd homes, and you will financial support attributes.

- Purchase purchases getting dominant homes and you will next property having up to 80% LTV/CLTV rates.

Assessment waivers can be available for services inside the large-requires outlying towns, as recognized by the new Federal Homes Loans Service (FHFA), subject to particular requirements, LTV/CLTV limitations, and you may contingent towards the a mandatory assets examination.

- Features with resale rate restrictions, collaborative tools, and you will are built belongings.

Property Evaluation Waivers (PIW) can certainly be sensed needless to say money, but individuals is stick to the advice provided with new particular providers otherwise people.

WhatsApp

WhatsApp

Recent Comments