Wisconsin is a wonderful location to feel an initial-big date house client along with its beautiful terrain, thriving towns and good housing industry. To order property will likely be pleasing but challenging especially for basic time people. This article usually walk you through your house to get techniques from inside the Wisconsin covering subject areas such as for example minimal credit history conditions, fee direction apps and differing home mortgage choice.

Starting out

Just like the a first-date house customer when you look at the Wisconsin, there is of several information and you may programs to manufacture your own dream about homeownership a reality. The newest Wisconsin Construction and you will Economic Invention Authority (WHEDA) offers of numerous mortgage software and you will commission recommendations choices to produce started. WHEDA’s down payment guidance applications bring next mortgages to fund advance payment, settlement costs, and/otherwise prepaids. Understanding these types of resources could make purchasing your basic domestic during the Wisconsin far more easy.

Other mortgage applications have additional credit rating standards and you may once you understand in which your stay will help you choose the best financial. Fundamentally, increased credit history often qualify your for top interest rates and you may mortgage terminology that is essential for first time homebuyers in the Wisconsin.

Fee Guidelines Programs: Commission guidelines programs was a must for some basic-big date buyers. Wisconsin has several applications to support off costs and closing will set you back in order to afford your first domestic. This type of applications provide provides, low interest rates fund or forgivable financing to help link the new monetary gap.

Monetary Development: The newest Wisconsin Housing and you can Monetary Innovation Authority (WHEDA) was a switch user in helping very first time home buyers because of mortgage programs and you will financial help choice. WHEDA’s purpose is to provide affordable property and you can financial progress therefore it’s an effective financing to own very first time consumers during the Wisconsin.

Variety of Loans

FHA Mortgage: The fresh new Government Casing Administration (FHA) financing is actually a favorite among first-time homebuyers from inside the Wisconsin. FHA money have lower down commission conditions as they are significantly more lenient having credit history conditions very alot more buyers can be qualify. These finance try covered because of the FHA and so the exposure try all the way down for the bank, and additionally they can offer top conditions to your debtor.

Traditional Loan: Antique finance try another option to possess Wisconsin owners. Such finance require a top credit history but give even more independency that have mortgage quantity and you can terminology. Conventional funds can be repaired speed or changeable speed, so you enjoys choices to fit your financial situation and you may requirements.

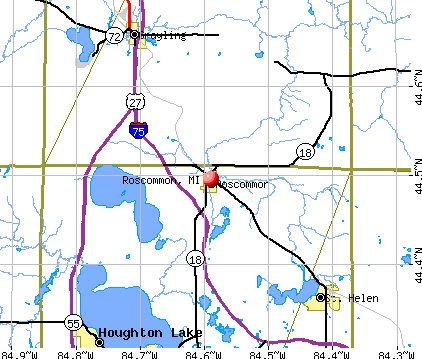

USDA Finance: If you’re looking to order a single-family home within the an outlying city, USDA loans bring no deposit and you can competitive interest levels. Such loans is actually supported by the fresh new You.S. Department of Agriculture and are made to render rural innovation. Wisconsin has some parts that qualify for USDA fund, so this is a great selection for those finding a rural existence.

Va Mortgage: Qualified veterans can use Virtual assistant financing which have ideal terms and conditions and you can often zero individual home loan insurance rates. This type of loans was guaranteed by the You.S. Department away from Pros Things and so are to assist experts get to homeownership. Wisconsin features a big veteran population and Va finance was an excellent significant advantage when you have offered.

WHEDA Mortgage: WHEDA financing are to have Wisconsin owners simply and supply aggressive costs and you can percentage advice. These funds are designed for first time home buyers in the Wisconsin so you feel the support and information in order to along just how.

Financials

Downpayment: One of the greatest obstacles for very first time buyers is the advance payment. Wisconsin has numerous down payment recommendations programs to aid qualified consumers fulfill it needs. Software instance WHEDA Resource Availability DPA give financial help to reduce the newest initial can Mississippi personal loans cost you of shopping for a property.

WhatsApp

WhatsApp

Recent Comments