And this? Required Seller getting mortgage loans 2022

We’ve got titled Very first Lead a that is? Recommended Supplier, predicated on a mixture of is a result of the 2022 customer satisfaction questionnaire and specialist financial studies.

Very first Direct attained a customers get out of 80%, with five a-listers for everyone regions of its service, and you can our research found it consistently offered a few of the most affordable mortgages in the industry.

We in addition to analysed fourteen most other brands. Read on to determine and that brands also obtained very which have customers to the components such as affordability, app process, customer care and much more.

From year to year, we questionnaire a large number of mortgage customers to reveal the brand new providers leading the way toward services they offer. I also analyse a great deal of residential mortgages to discover the lenders providing the most competitive purchases.

Customer satisfaction

During the , i interviewed step three,262 people in the public regarding how fulfilled these were through its mortgage lender. Some tips about what i discover:

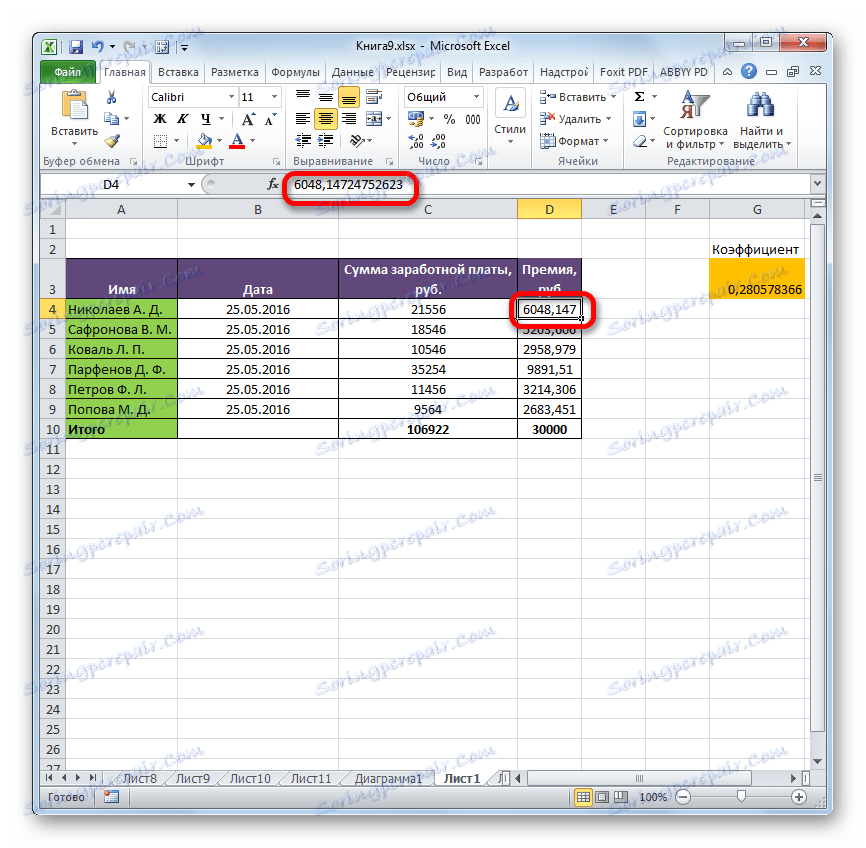

Table notes: Consumer get centered on a survey of 3,262 members of the public for the . The typical customer get are 70%. Celebrity recommendations away from five show amounts of satisfaction with each town. Consumer scores is actually worked out using a mix of total satisfaction while the likelihood of indicating the newest provider in order to a buddy. In the event the a couple of labels tell you the same complete score, he or she is ranked alphabetically. Team must discovered the absolute minimum attempt size of forty getting inclusion throughout the desk. In which a good ‘-‘ try found i have an insufficient take to proportions (below forty) to calculate a superstar get. Take to versions in mounts: Agreement quick payday loans Simsbury Center Mortgage loans (52), Barclays Financial (295), Coventry Building Neighborhood (67), Very first Lead (82), Halifax (458), HSBC (240), Leeds Strengthening Neighborhood (47), Lloyds Lender (111), Nationwide Strengthening Society (600), NatWest (283), Platform/ The newest Co-Op (49), Royal Bank regarding Scotland (59), Santander (391), TSB (92), Virgin Currency (62).

Sale studies

Our positives also analysed countless mortgage loans more a four-month several months for the . It built-up a series of dining tables of top ten least expensive sales considering some credit circumstances, and you can measured how frequently for each bank looked from inside the a table.

The average number of moments a loan provider made it into the a least expensive income dining table is actually sixteen. Seven names did above the average:

- First Lead

- Regal Lender regarding Scotland

- NatWest

- Halifax

You will discover much more about our package study, as well as how each financial performed, in our private lending company critiques.

Precisely what does they test become a this is certainly? Demanded Vendor?

- have attained a premier buyers rating when you look at the a that’s? customer satisfaction survey

- consistently give dining table-topping home loan selling more some unit designs

And that? directly inspections the items and methods of all the recommended team, and you may supplies the right to prohibit any organization that does not eradicate its customers very.

How to choose an informed home loan company for you

Instance, particular loan providers become more prepared to bring mortgages to help you self-employed homeowners, although some specialize in guarantor mortgage loans otherwise solutions if you have the lowest credit history.

An educated lender for you would not simply be influenced by that has providing the low interest and/or greatest financial.

Determining the most likely style of mortgage if it is a predetermined-rate, tracker or dismiss is crucial to make certain the mortgage suits you.

It’s also wise to take a look at charges which might be linked to the bargain, as these can add plenty to what you can spend full.

Whenever you are struggling to understand and this financial is worth opting for, you must know getting recommendations from a different, whole-of-field large financial company before applying getting a home loan.

Just how home loan team regulate how far to give your

When selecting a house, it is far from just the put you really need to think of but plus the sized financial you can buy.

Loan providers need to heed rigorous financial affordability laws, which means they have to lend sensibly and ensure you could manage to repay the borrowed funds, both today plus the future whenever rates could go right up.

Simply how much must i acquire?

Extent you might obtain will be based on your earnings, if you really have people dependents and you can specific outgoings such as for example monthly money towards the playing cards and other money.

Typically of thumb, lenders always allows you to acquire up to four-and-a-half of minutes your earnings, but this can are very different significantly depending on the merchant you employ and their financing standards.

Like, particular loan providers can give higher money multiples to the people having high earnings, those borrowing within a reduced mortgage so you’re able to well worth (LTV), otherwise those with safe work for the specific marketplace.

Consequently there is certainly an improvement out of tens away from a lot of money between how much cash other loan providers allow you to use, therefore would not actually know how much you can get out of a particular bank if you don’t use and you may proceed through a complete borrowing from the bank evaluate and you may home loan cost review.

But it’s value talking-to a mortgage broker before you apply getting a home loan. They shall be capable advise about exactly how much you might obtain, in addition to hence lenders are most likely to just accept you.

Do you know the greatest mortgage lenders in britain?

Based on analysis from Uk Financing, the greatest lenders during the 2021 have been as follows. Hyperlinks take you to your ratings of every vendor:

Going for a primary financial may have certain advantages such as for instance, they often bring an extensive range of products, and have a great deal more twigs offered.

Nevertheless don’t need to fit into one of the big members because you realise the name, otherwise you will be already a buyers. Reduced lenders, and building societies, can offer tailored products which most readily useful match your types of situations.

If you prefer help managing your money inside the price of traditions drama, try all of our free My personal Currency Medical exam tool having customised money-saving information.

WhatsApp

WhatsApp

Recent Comments