A house buyer is also plan a home loan to assist pay money for the house pick. The loan ‘s the quantity of the borrowed funds taken because of the house customer throughout the bank who has got provided to financing the pick as per the fine print of one’s lending agreement.

A prospective homeowner normally create a home loan to help with investment the acquisition off a house. The borrowed funds signifies extent borrowed by the home buyer off a lender. The educated financial attorneys during the Nanda & Representative Attorneys understand https://paydayloansconnecticut.com/deep-river-center/ all facets out of financial laws and regulations and regulations. They are able to give specialised, cure solutions for every single book circumstances. Their home loan company can also be posting information to a single in our financial attorneys to accomplish the borrowed funds financial support processes.

This new consumer contains the obligation to ensure and you can plan the borrowed funds resource if required to do the purchase deal. Just after organizing the mortgage, the new buyer has to:

- Effectively clear all lender conditions having earnings, debt burden, cash deposit proofs as needed (needs to be done in the timelines to cease delays for the this new closing time)

- Make certain that home loan regulations and you can directions try sent to the latest A home Attorney of the home loan company to undertake the mortgage investment processing (they’re going to plus ensure that the expected mortgage financing needed for the new closure try gotten)

Composed Pre-Approval

However, if a purchaser picks to possess a great pre-approval before purchasing the home, it must be for the composed means. It is recommended that the latest small print of one’s mortgage in addition to pre-acceptance is actually certainly acquired in writing.

Energy away from Lawyer

If the an electrical energy out of lawyer is employed throughout the pick purchase, it should be pre-authorized by the mortgage lenders. Are a customers of one’s lender otherwise finalizing an electricity from lawyer document throughout the exposure regarding an Ontario Lawyer are pre-requisites to get new approval.

Conditional Funding

A binding agreement out of deals and get would be made conditional inside the the individuals instances when funding will become necessary. It’s best that contract are going to be reliant the financial support conditions and terms, given that affirmed written down of the organization bank.

Open and you will Closed Mortgages

Open mortgages commonly at the mercy of any penalty if they are paid down. Finalized mortgages try susceptible to punishment if they’re repaid till the avoid of one’s financial readiness several months. The fresh new punishment amount is often the high of your rate of interest differential otherwise attention for a few days. Into the variable rates mortgage loans, brand new punishment might be 90 days attract.

Bi-per week and you can per week fee options are given to homeowners by the new organization lenders. These commission options let the homeowners to minimize the attention cost and you will pay back brand new mortgage loans easily. Repayments amount a lot more for the prominent financial amount, plus the lifetime of the mortgage is additionally reduced.

Canada Mortgage and you will Homes Enterprise Mortgages (CMHC)

For everybody covered mortgages, specified costs are deducted from the mortgage advance because of the home loan company. During the insured mortgages, dollars advance payment was less than you to-5th of your overall cost and that’s create because of the buyer.

The borrowed funds lender normally deduct of several will set you back also appraisal commission; property taxes kept, interest improvements and you may provincial conversion taxation part of the financial insurance coverage superior.

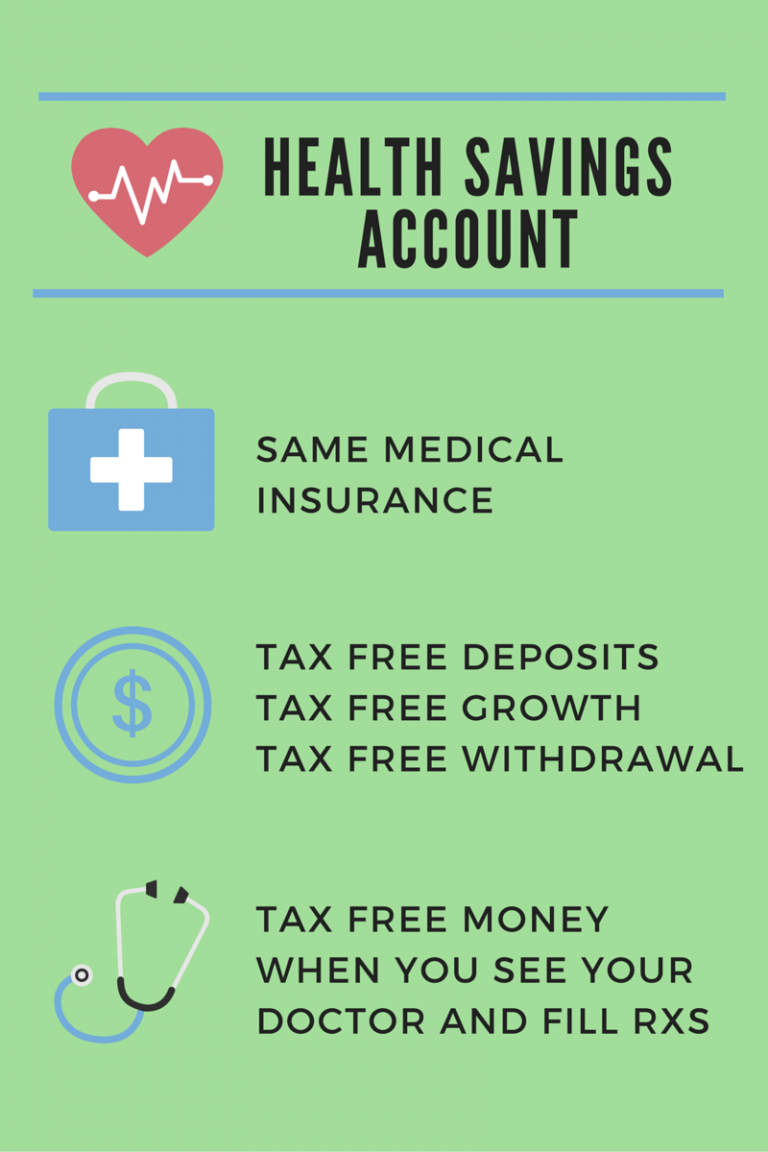

Possessions Insurance rates

Lenders tend to envision doing home loan capital only if the house or property insurance might have been pulled. Understand the right amount of possessions insurance policies, four situations come into play.

Home loan harmony

The mortgage balance ‘s the quantity of mortgage money an excellent on the your residence. The lending company considers which total end up being the worth of the possessions.

Market price

ount any purchaser manage spend purchasing the house whenever vendor and you can customer both are maybe not less than one emergency in order to make the fresh exchange.

Replacement cost

Brand new Replacement for cost refers to the buck well worth which will feel needed seriously to rebuild your residence in the certain area of house. It worth is essential on the insurance coverage view point as this ‘s the amount and this your property could be covered getting.

Actual cash Worthy of

The genuine bucks really worth ‘s the depreciated worth the costs to correct our home now deducted of the depreciation matter.

Playing with a guaranteed substitute for pricing endorsement is better in case your financial harmony try less than the brand new substitute for price of your home. You can consider this throughout cases where you own your own possessions that have a very clear identity.

However if, your property is more than two decades dated and you can the new building codes have been brought, you can look at an affirmation on the policy. Which approval usually covers the expense of reconstructing to meet up with the fresh new highest standards.

Tax Ramifications out-of Mortgage Investment

Home loan attention payments dont be eligible for taxation write-offs. He’s qualified to receive a deduction only when our home was producing money from are leased aside. If you work at a company from your home, of many team expenditures might be subtracted although notice towards mortgage can’t be subtracted.

How we Can help

From the Nanda & Affiliate Attorneys, all of our knowledgeable Real estate attorneys discover your specific activities and gives tailored and tailored possibilities each of those.

Our very own Mississauga A property Solicitors are offered for a good consultatione and you may experience our top quality legal advice and personalized care we give to for every customer. We be sure quick interaction and you can an expert approach to go effective outcomes for your.

Feel comfortable getting together with all of our compassionate people whom chat more 15 languages for example English, French, Foreign-language, Italian, Portuguese, Albanian, Hindi, Punjabi, Kannada, Telugu, Tamil, Bengali and.

WhatsApp

WhatsApp

Recent Comments