In a few situations, homeownership may seem like an expensive fling, having homeowners perhaps trying to find financial help getting household home improvements otherwise solutions. Why don’t we explore how do it yourself fund work and many preferred ways to finance certain assets upgrades.

What is actually a house upgrade loan?

A house improvement financing is established to help property owners fund renovations, repairs and you may house enhancements. It will shelter methods eg roof replacement for, toilet otherwise cooking area updates, home additions, energy-show developments or disaster repairs.

Basically, there isn’t you to definitely devoted “do it yourself mortgage” you to loan providers may offer. Rather, consumers might just use a few different varieties of money getting home home improvements, such as for example a home security loan otherwise bucks-out re-finance selection.

3 sorts of home improvement financing

People may have a few options to invest in its fixes and renovations. Let us talk about a number of the prominent home improvement loans as well as how they work.

step one. Personal bank loan

An unsecured loan are often used to security whichever sort of off debts (however some lenders might reduce means a debtor can use it). Instance autonomy is certainly one advantageous asset of unsecured loans, next to an array of choices to select and you will a great seemingly quick time and energy to secure financing.

If you’re other loan types need a form of collateral, signature loans normally you should never incorporate that requirement. However, that it grounds makes it riskier towards lenders, it could produce highest interest levels in comparison with other do-it-yourself financing sizes. Observe that JP Morgan Pursue doesn’t promote signature loans.

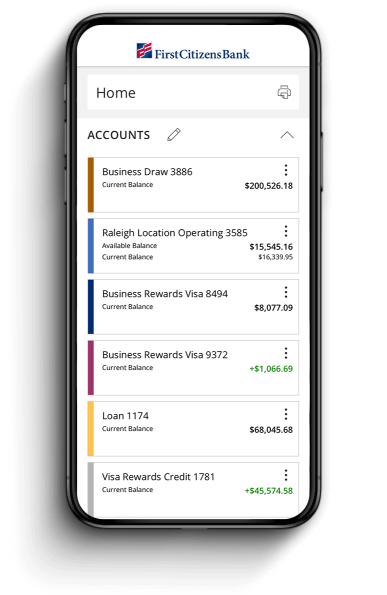

dos. Household equity mortgage

A house collateral financing is an additional means residents are able to finance renovations. It may look slightly exactly like a moment mortgage – a borrower gets profit you to share and repays the loan at a fixed interest rate to have an established period. In addition to this, the interest paid off into property guarantee mortgage could be tax-allowable in certain situations. Pursue cannot offer Domestic Guarantee Funds nor Household Security Contours out of Credit (HELOC) nowadays. Head to the HELOC page to own coming position.

A house guarantee financing spends our home since guarantee, so it’s fundamentally expected to end up being best one of residents whom enjoys created significant collateral over the years. Generally, many loan providers are likely to supply in order to 80% of the collateral having a property guarantee financing. For similar reasoning, that it financing get hold significantly more risk getting consumers because the failing to afford the financing could potentially end in foreclosures.

step three. Cash-out re-finance

A funds-aside refinance you will wind up as a home security financing: It also allows people in order to tap into the home guarantee it oriented before. not, it’s got a different sort of method, where consumers have access to funds cash advance Chester Center reviews by replacement a home loan having a the fresh, large you to and you may discovered most dollars (which you can use to own home improvement plans). A money-away refinance might also incorporate all the way down rates of interest than private or home collateral finance. Yet, it could enjoys disadvantages getting borrowers, including a requirement to invest closing costs and using the fresh household as equity. JPMorgan Chase does not render tax advice. Please check with your income tax mentor regarding the deductibility interesting having renovations.

Important Find so you can Servicemembers as well as their Dependents: A great refinance may not be great for you whenever you are already eligible for masters provided by brand new Servicemembers Civil Relief Act (SCRA). Whenever you are a keen SCRA-qualified customers and have now questions about the newest SCRA or about refinancing, please seek the advice of your property Credit Mentor. The amount it will save you into good refinanced home loan may vary because of the loan. If the a refinanced home loan has actually a longer name than stays toward your current mortgage, you are going to incur more appeal prices for brand new extended name.

WhatsApp

WhatsApp

Recent Comments