They pride themselves with the focusing on how the father or mother organizations framework timelines performs so that your home (and) financing stay on agenda.

It indicates you might be capable of getting your hands on a minimal financial rates you to additional loan providers just can’t beat.

Read on more resources for these to know if it would-be a great fit for your financial means.

Promote Home loans Also provides Huge Speed Buydowns

- Direct-to-consumer mortgage lender

- Has the benefit of house pick financing

- Depending into the 2016, based inside the Newport Beach, California

- A completely had subsidiary from Century Teams

- Parent organization is in public exchanged (NYSE: CCS)

- Authorized in order to give in 18 states across the country

- Financed on the $dos mil in home funds into the 2022

- Most active when you look at the California, Colorado, Georgia, and Colorado

- Also operates a concept business and insurance company

Motivate Home loans is actually an entirely had part away from Century Communities, which provides so you can-be-established and you can quick move-in the homes into the some states across the country.

The primary attract is offering home purchase finance to help you consumers of newly-oriented belongings throughout the of a lot organizations they services regarding country.

They are signed up when you look at the 18 claims, as well as Alabama, Arizona, California, Texas, Fl, Georgia, Indiana, Louisiana, Kentucky, Michigan, Nevada, North carolina, Ohio, South carolina, Tennessee, Colorado, Utah, and you will Arizona.

Just like almost every other builder-affiliated lenders, Inspire Home loans payday loan Crook including operates a name insurance and you will payment team called Parkway Title, and you can an insurance institution titled IHL Home insurance Institution.

It indicates you are able to do you to definitely-stop seeking all of your current financial needs, whether or not it is usually wise to buy around for this type of third-party qualities too.

How to begin

You can either see a Century Organizations brand new home conversion place of work to locate paired up with a loan officer, or simply go surfing.

If you visit the website, you might simply click Pre-qualify Now to view a loan administrator directory one listings the countless teams operate by their father or mother team.

Shortly after seeking your state, you’ll be able to pick a residential district to determine what mortgage officers suffice that certain development.

From there, you will see contact information and you might be able to rating pre-eligible to a mortgage or sign in if you’ve already used.

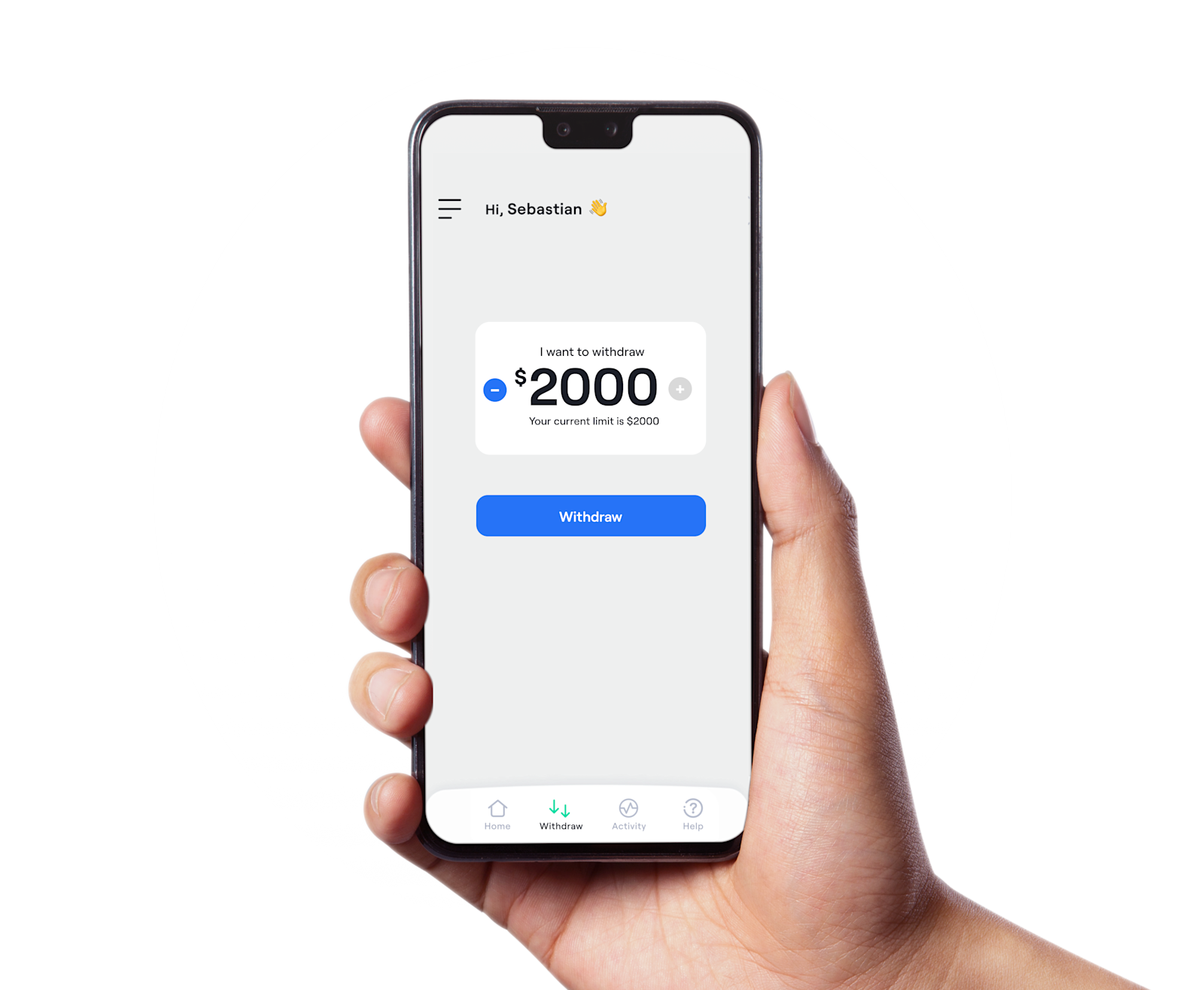

Its digital loan application was powered by fintech business nCino. It permits one to eSign disclosures, hook up monetary levels, and finish the app out of one tool.

You could slim on the faithful, people financing team which can be found to help and offer solutions when you features concerns.

They look supply an effective equilibrium out-of one another technical and you will peoples contact to cause you to the finish line.

And since they are affiliated with the newest creator, they’ll certainly be capable share freely and sustain your loan into the song based on structure status.

Loan Software Provided

When it comes to mortgage possibilities, obtained all of the biggest loan software property visitors you will you need, in addition to compliant funds, jumbo loans, additionally the complete assortment of authorities-supported money.

The fresh Ascent Club

This might were learning to cut for an advance payment, how to get house supplies, tips increase credit ratings, plus replace your DTI proportion.

And you will regardless if you are a primary-big date household customer or veteran, it perform free webinars to answer one mortgage inquiries you may also possess.

Promote Mortgage brokers Rates and Charges

They will not checklist its home loan prices otherwise financial charge online, hence actually atypical. But I actually do bring lenders kudos when they do. Its a bonus of a visibility standpoint.

Therefore we don’t know how aggressive he or she is relative to other lenders, neither do we know if they charge a loan origination percentage, underwriting and you may operating costs, app percentage, and the like.

Make sure to require every costs after you basic explore loan rates having a mortgage loan officer.

Once you get an increase quote, one to and the bank costs accounts for the mortgage Apr, that is a definitely better answer to compare loan costs of lender to bank.

One example offered a two/1 buydown to three.5% towards first 12 months, 4.5% inside year a few, and 5.5% fixed to the leftover 28 many years.

That is very tough to defeat whenever mortgage pricing are close to 7.5 today%. This will be one of the several great things about by using the builder’s lending company.

But bear in mind, take care to store the speed along with other loan providers, credit unions, lenders, etc.

Promote Home loans Recommendations

However, they have a-1.8/5 to your Yelp from about 30 analysis, even though the shot dimensions are without a doubt quite small. At the Redfin he has got a better 4.4/5 out-of eight feedback, and that again is actually a tiny sample.

You may browse its private offices in the nation on Bing observe studies because of the place. This is a lot more of use if you use a certain local office.

The parent organization has actually an A+’ rating to the Bbb (BBB) site and it has become licensed since 2015.

In spite of the solid letter stages score, they usually have a poor step 1.05/5-star rating based on more than 100 customers critiques. This could relate to its multiple issues registered more many years.

Make sure to make sure to search through a number of them to see how of numerous pertain to its financing section versus their new home building equipment.

Needless to say, its likely that while you are playing with Promote Home loans to acquire an excellent financial, you’re and to acquire good Century Groups assets.

So you can share anything up, Convince Home loans has the latest tech, a good assortment of loan apps, and can even provide rates specials one to outside loan providers cannot take on.

He’s specific combined feedback, however, primarily self-confident of these, though the usage can vary based on whom you work on.

Still, take care to shop 3rd-class lenders, brokers, banking institutions, etcetera. Along with other now offers at hand, you could potentially discuss and you can potentially home an even greatest price.

WhatsApp

WhatsApp

Recent Comments