If you wish to pick an article of belongings simply and you may fund they using a prescription FHA financial, that kind of financing device is maybe not offered. Although not, the FHA insured program will allow for the acquisition from homes if it’s combined with framework costs to create a good brand-new home. They’ll create all those can cost you to settle one loan and just require the absolute minimum downpayment of step 3.5% and all will likely be finished which have one to closing. To buy homes having an enthusiastic FHA loan is completed alongside a keen FHA design loan, and is a common brand new home framework ability to own Stick-Creates, modular and you may are made belongings.

HUD 4000.step one has many earliest tips to your bank regarding the purchase regarding property within the FHA financing process:

The fresh Borrower have to be purchasing the residential property at closure away from the construction mortgage, otherwise keeps owned the brand new homes getting half a year or less on brand new day away from situation amount assignment.

As with a great many other areas of the fresh new FHA loan techniques, there are some do’s and you will don’ts is conscious of whenever to buy property as part of an enthusiastic FHA financial.

There are plenty of professional-individual rules enacted to guard buyers who wish to own land, however, there are also some great, common sense something buyers is going to do to guard themselves irrespective of men and women guidelines.

But, it’s never ever best if you get house without checked it basic. Customers is to remove a land purchase the same as they will your house itselfwho would buy a house with no a look at it very first? A similar idea will be book a land pick-particularly if the belongings is paid for along with an FHA One-Time Close framework loan.

The new FHA suggests doing some research towards the designer of landwhat is the developer’s reputation on the neighborhood? Normally some body truth be told there highly recommend them? Precisely what does your own bank or agent state on the subject.

Making an application for an enthusiastic FHA real estate loan Grover loans no credit check means you’ll be appointment such of people who you’ll understand who is reliable and who isn’t. Request a viewpoint.

We’re not paid for promoting or suggesting lenders otherwise financing originators and do not otherwise benefit from doing this

Never give up so you’re able to higher-stress transformation ideas, especially those presented over the phone. Usually insist upon learning every contracts and constantly inquire about explanation on the people area of the contract you never know before signing.

Particular even more legislation get use in the event there was just what the FHA deems to get excessive or way too much house. Speak to your loan manager on these types of regulations if you are worried they may apply to your own transaction.

One-Time Close Loans are for sale to FHA, Virtual assistant and USDA Mortgage loans. These types of loan enables you to financing the purchase of your own homes along with the structure of the home. You’ll be able to play with home that you individual 100 % free and you may clear or keeps a preexisting financial.

These finance in addition to pass another brands: 1 X Personal, Single-Close Financing otherwise OTC Loan

I’ve over extensive search on the FHA (Government Construction Management), the brand new Virtual assistant (Institution from Experts Products) while the USDA (Us Department from Agriculture) One-Time Personal Structure loan apps. You will find verbal right to signed up loan providers one to originate these types of home-based loan types in most says each team has provided you the guidelines due to their things. We are able to link your that have home mortgage officials who work to have lenders you to understand device better and just have constantly given top quality provider. If you’re selecting getting contacted to just one signed up design lender in your area, excite post responses toward issues less than. All of the info is addressed confidentially.

OneTimeClose will bring suggestions and connects people to help you certified That-Time Close loan providers in an effort to raise feel about this loan device also to help consumers discover higher quality services. Consumers would be to search for home loan characteristics and examine their possibilities just before agreeing so you’re able to just do it.

Please note that investor guidelines into FHA, Va and you will USDA You to-Date Personal Construction System just allow for single loved ones homes (step one equipment) rather than having multiple-family unit members products (zero duplexes, triplexes otherwise fourplexes). You simply can’t try to be their general company (Builder) / not available throughout States.

Concurrently, this can be a limited variety of another house/building looks that aren’t enjoy around these types of applications: Kit House, Barndominiums, Vacation cabin otherwise Bamboo Belongings, Shipments Basket Belongings, Dome Belongings, Bermed Environment-Sheltered Land, Stilt Belongings, Solar (only) or Wind Pushed (only) Belongings, Tiny House, Carriage Homes, Accessory Dwelling Systems and An effective-Presented House.

The email to help you authorizes Onetimeclose to share your own personal information with a home loan framework lender subscribed near you to make contact with you.

- Post the first and you will history term, e-send target, and contact number.

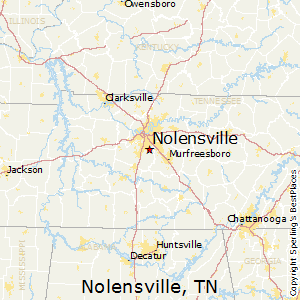

- Inform us the city and county of your own proposed property.

- Let us know the and you can/or even the Co-borrower’s credit reputation: Expert (680+), A good (640-679), Fair (620-639) otherwise Poor- (Below 620). 620 ‘s the minimum qualifying credit rating because of it device.

- Are you presently otherwise your lady (Co-borrower) eligible experts? In the event that sometimes of you are eligible veteran’s, down costs only $ount your debt-to-income proportion Va allows there are no maximum loan numbers depending on Va direction. Really loan providers goes up to $step 1,000,000 and you may comment highest financing wide variety on an instance by case foundation. If not a qualified seasoned, the newest FHA advance payment is step three.5% up to the fresh maximumFHA lending limitfor your own county.

WhatsApp

WhatsApp

Recent Comments